Finance Degree Apprenticeships

In today's competitive job market, young people are increasingly looking for alternatives to the traditional university route. Finance degree apprenticeships offer an exciting opportunity to earn while you learn, gain invaluable industry experience, and graduate with zero student debt. Let's explore what makes these programs so attractive and how they're reshaping careers in the financial sector.

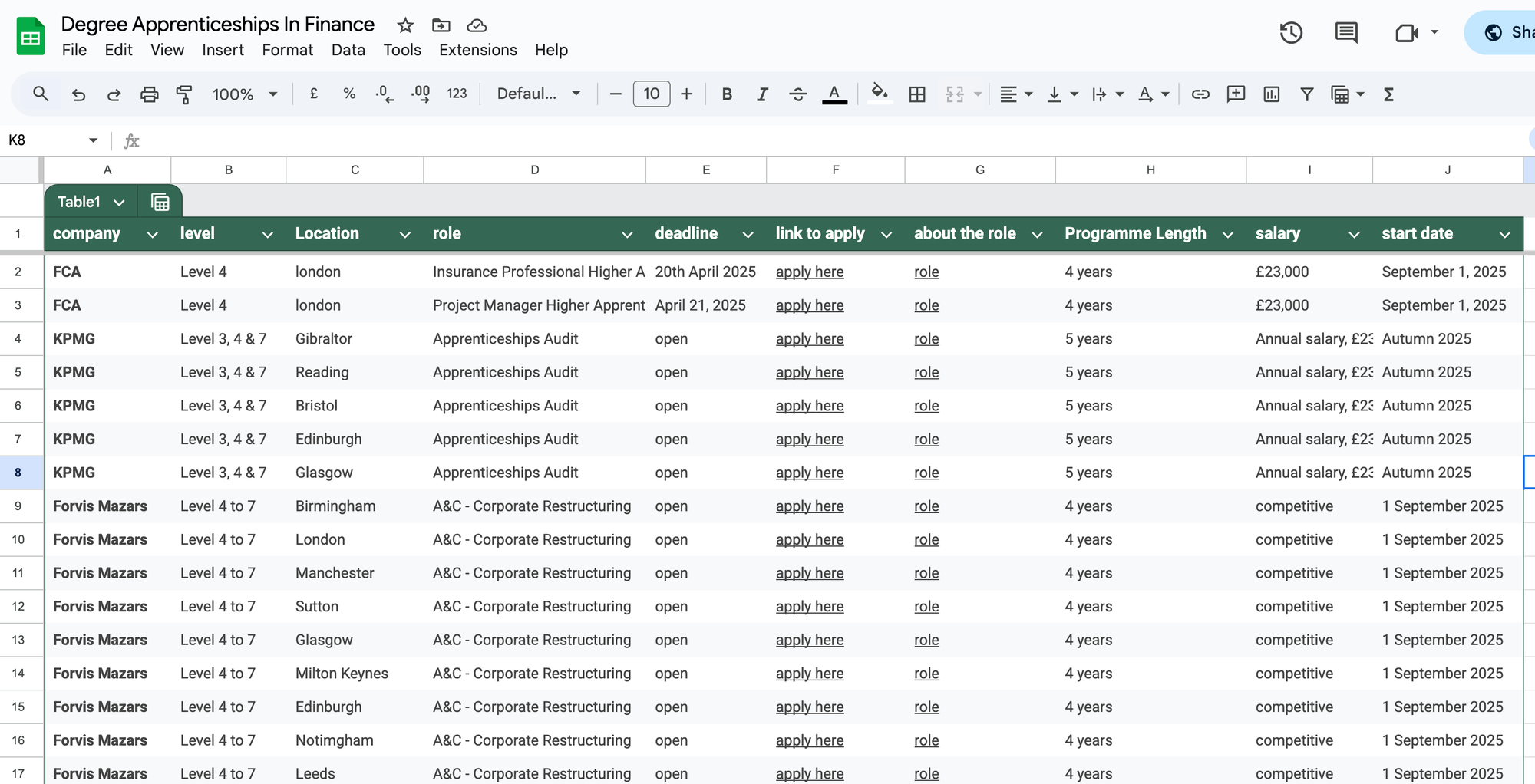

To get the google sheets with the latest up to date jobs and tracking sign up below

What Are Finance Degree Apprenticeships?

Finance degree apprenticeships combine full-time employment with part-time university study, allowing you to earn a full bachelor's degree while gaining real-world experience in the financial sector. These programs typically run for four years, with apprentices splitting their time between workplace training and academic study.

Several prestigious institutions offer these programs in collaboration with major financial organizations. For example, Queen Mary University of London has designed apprenticeship programs in partnership with industry leaders, while the London Institute of Banking and Finance offers specialized financial services qualifications.

Top Employers Offering Finance Degree Apprenticeships

Some of the world's leading financial institutions now offer degree apprenticeships:

- Goldman Sachs offers four-year programs in partnership with Queen Mary University of London, providing a head start in the investment banking world

- JP Morgan runs Financial Services Apprenticeships for candidates with strong analytical and communication skills

- UBS provides pathways to a Bachelor of Science in Applied Finance

- Deutsche Bank offers an Investment Banking Apprenticeship program with full financial sponsorship toward an Applied Finance degree

Competitive Compensation

Finance apprenticeships are among the highest-paying apprenticeship sectors in 2025. According to Glassdoor data, JP Morgan apprentices earn between £19,000-£29,000 per year, including base salary and additional pay. The average base salary is around £21,000 with potential for additional compensation of approximately £2,000 annually.

While specific figures for Goldman Sachs apprenticeships weren't detailed in the provided information, their programs are likely to offer competitive compensation packages given the firm's reputation and industry standing.

Entry Requirements

Entry requirements vary by employer but are generally demanding:

- JP Morgan requires the UCAS equivalent of 3 B grades at A-Level or other qualifications (B grade or higher)

- For Goldman Sachs' Retail Banking Apprenticeship in Knutsford, you'll need 3 A levels (or equivalent) at B grade plus GCSE Maths and English at A*-C (9-5)

Competition for these positions is fierce, with employers looking for candidates who demonstrate strong analytical abilities, excellent communication skills, and a genuine passion for financial services.

Career Pathways

A finance or accounting apprenticeship can lead to various lucrative career paths, including:

- Accountant

- Actuary

- Broker

- Insurance underwriter

- Financial analyst or adviser

- Financial manager

- Financial risk analyst

- Project manager

- Retail banker

- Cyber security analyst (specialized in financial services)

- Data analyst (focused on financial data)

Why Choose a Finance Degree Apprenticeship?

1. Practical Application of Knowledge

As noted by UCAS, "Studying accountancy through an apprenticeship is a great pathway to take, as it enables you to focus on developing specific skills and knowledge, learning the theory behind them, and then being able to apply this to your work the very next day."

2. Competitive Advantage

Because you'll gain extensive workplace experience while earning your degree, you'll have a significant advantage over traditional graduates who may lack practical experience when entering the job market.

3. Financial Benefits

With no student debt and a salary from day one, the financial benefits are substantial. Finance apprenticeships are consistently ranked among the best-paying apprenticeship sectors.

4. Direct Industry Access

You'll build a professional network and gain industry insights that would be difficult to access through a traditional degree program alone.

Is a Finance Degree Apprenticeship Right for You?

While these programs offer exceptional opportunities, they're not without challenges. Apprentices may experience stress from balancing work deadlines with academic requirements. According to industry reports, "apprentices can get stressed if they feel they don't have the skills or time to meet tight deadlines."

You'll need excellent time management skills, resilience, and a strong work ethic to succeed. But for those with determination and passion for finance, these programs provide an unparalleled foundation for a successful career.

How to Apply

Most finance degree apprenticeships are advertised through:

- Company websites (e.g., Goldman Sachs, JP Morgan)

- Government apprenticeship portals

Applications typically open 6-12 months before the start date, with programs usually commencing in September.

Conclusion

- Finance degree apprenticeships represent a modern, practical approach to building a career in the financial sector.

- They combine the academic rigor of a university degree with the practical experience and industry connections of an entry-level position.

- For ambitious individuals seeking to fast-track their finance careers while avoiding student debt, these programs offer a compelling alternative to the traditional university route.

- As the finance industry continues to evolve, employers increasingly value candidates who can demonstrate both theoretical knowledge and practical abilities—exactly the combination that finance degree apprenticeships are designed to develop.